Simple, Professional Pay Stub Maker

Create pay stubs online in minutes with a reliable check stub maker you can trust

at

$4.99

Create Pay Stubs Online — Fast, Accurate, and Easy

Create-Paystub.com is a straightforward solution for anyone who needs to create pay stubs quickly without complicated payroll software. Our online pay stub maker helps small businesses, freelancers, contractors, and employees generate clean, professional pay stubs in just a few minutes.

Instead of manual calculations or spreadsheets, our secure pay stub generator automatically handles earnings, deductions, and totals—so your pay stubs are clear, consistent, and ready to download or print.

Why Use Our Check Stub Maker?

- Easy to use: A simple step-by-step process designed for non-accountants.

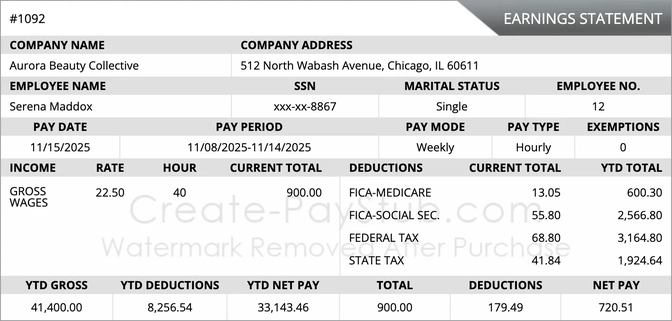

- Accurate calculations: Gross pay, deductions, and net pay are calculated automatically.

- Professional layout: Clean formatting suitable for recordkeeping and income verification.

- Instant access: Download or print your pay stubs online as PDF files.

Who Can Use This Pay Stub Maker?

- Small business owners who want a simple way to issue pay stubs.

- Freelancers and contractors who need real check stubs to document income.

- Self-employed individuals tracking earnings and deductions.

- Employees who need organized payroll records for personal use.

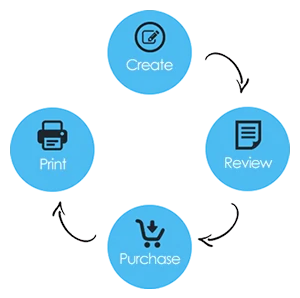

How to Make Check Stubs in 3 Simple Steps

- Enter basic details: Add employer information, employee name, and pay period.

- Add earnings and deductions: Include hours worked, overtime, taxes, and other deductions.

- Review and download: Check the details, then download your professional pay stub.

Key Benefits of Our Paystub Generator

Accurate Payroll Calculations

Our paystub generator reduces common payroll mistakes by automatically calculating totals based on the information you provide.

Clean, Professional Templates

Every pay stub is designed to be easy to read, making it suitable for documentation, personal records, and income verification needs.

Secure and Private

We respect your privacy. Information entered is used only to create your pay stub and processed securely.

Common Reasons People Create Pay Stubs

- Income documentation: Support rental or financial applications.

- Personal records: Keep organized proof of earnings.

- Tax preparation: Maintain clear payroll history.

- Business documentation: Issue consistent pay records to workers.

Frequently Asked Questions

Is it legal to create pay stubs online?

Yes. Creating pay stubs for legitimate payroll and recordkeeping purposes is legal. All information should be accurate and truthful.

Are these real check stubs?

The check stubs created reflect the information you enter and are formatted professionally for standard documentation needs.

How long should pay stubs be kept?

Most individuals and businesses keep pay stubs for at least three to seven years for tax and recordkeeping purposes.

Get Started with Our Pay Stub Maker

If you’re ready to create pay stubs online without hassle, our check stub maker offers a simple and reliable solution.

Make Your Paystub in Just a Few Steps

- Consent Settings

- Cookie Policy

- Privacy Policy

- Terms and Conditions